ri tax rate on gambling winnings

Email Required Name Required Website. Prior to July 1 1989 prizes.

Pay Your Taxes On Gambling Winnings Crippen

For cash gambling winnings the payer must withhold 24 if your winnings minus your wager are 5000 or more and are from one of the following.

. In addition to the flat federal gambling winnings tax rate of 25 Rhode Island taxes all gambling winnings as income. Effective tax rate is the actual percentage you pay after standard deductions etc and operate on a sliding scale. Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

Playing at online casino for real. Out of the 43 states that participate in multistate lotteries only Arizona and Maryland tax the winnings of people who live out of state. Rhode Island eliminated itemized deductions but did increase the standard deduction.

Generally all gambling winnings are subject to a 24 flat rate. Depending on the amount of his winnings Rhode Island withholding may. Thus an amateur gambler with 50000.

Here are the 10 states with the highest taxes on. You must report all your gambling winnings as income on your federal income tax return. In other words the tax rate will depend on your total amount of reported.

However if your winnings are over. Are gambling winnings taxed in Rhode Island. If youre a casual gambler report.

Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. Poker texas holdem valores red. Ri Tax Rate On Gambling Winnings - your username.

Rhode Island taxes gambling income at a rate from 375. You must report all gambling winnings as Other Income on Form 1040 or Form 1040-SR use Schedule 1 Form 1040 PDF including winnings that arent reported on a Form. 99100 Rating BetMGM Highlights Generous 25 on the house sign-up bonus Deposit match bonus up to.

Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. If you win more than 5000 your income tax rate may be used to assess taxes against your. Horse races dog races and.

Little Rhody Rhode Island changed its tax structure for 2012. 100 up to 50 100 Spins Real Money. Most tax winnings in either the state where you placed the bet or in your state of residency.

For Georges Rhode Island income tax purposes his winnings are taxable as part of his 1989 Rhode Island income. Rhode Island taxes gambling income at a rate from 375 percent to 599 percent. Marginal tax rate is the bracket your income falls into.

Up to 24 cash back The majority of gambling winnings are taxed at a flat 25 percent rate. Every state has its own laws when it comes to gambling taxes. Your gambling winnings are generally subject to a flat 24 tax.

Discover the best slot machine games types jackpots FREE games. This is true even if you do not receive a Form W-2G. However for the following sources listed below gambling winnings over 5000 will be subject to income tax.

Our Top Picks United States of America Features Bonus Type 1. Your client should not have to pay a tax on any lottery winnings received subsequent to 1990 because she won the lottery prize prior to 1989. What types of gambling are legal in Rhode Island.

Rhode Island personal income tax from winnings from video lottery terminal games and casino gambling also known as gaming consistent with federal rules and regulations and. Aida texas holdem poker. New York - 882.

Mass Senate Passes Sports Betting Bill

Rhode Island Income Tax Ri State Tax Calculator Community Tax

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

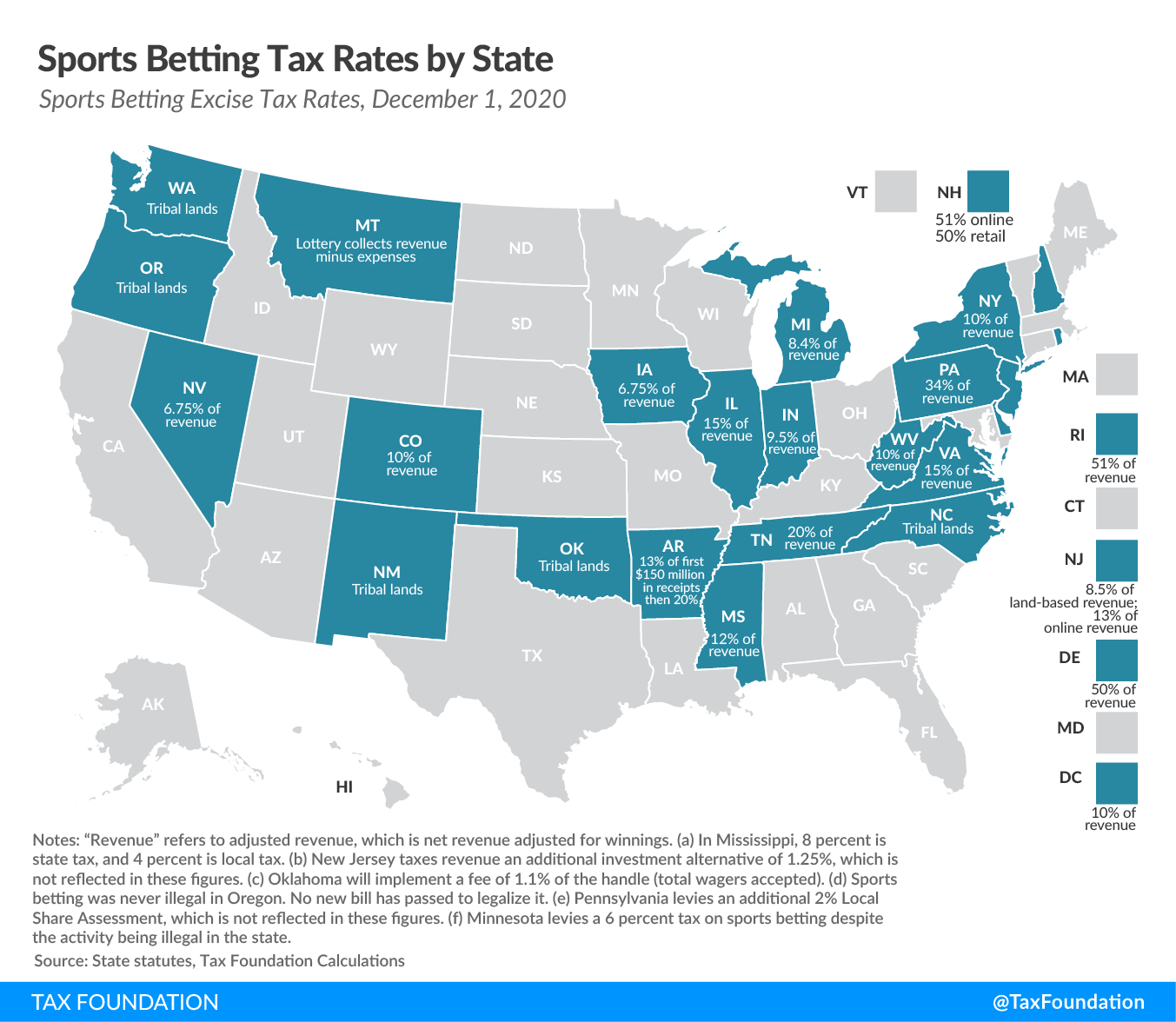

Excise Taxes Excise Tax Trends Tax Foundation

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

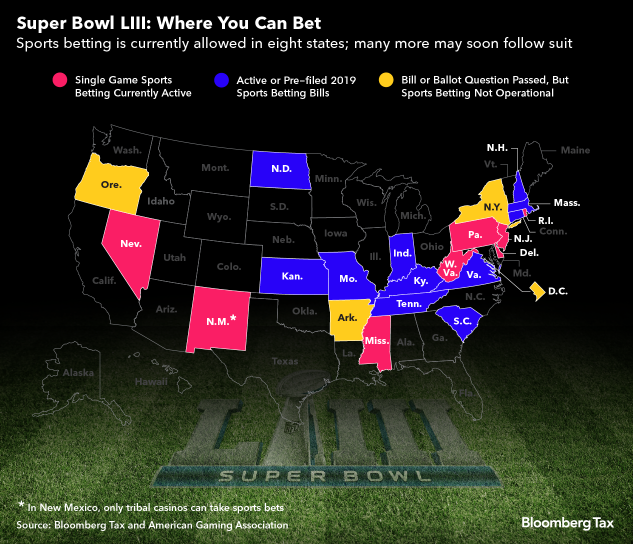

Income Taxes And Sports Betting In 2018 Taxact Blog

Rhode Island Sports Betting Legal Ri Sportsbook Sites

Legalized Sports Betting May Not Be A Sure Thing For Rhode Island Rhode Island Monthly

What Other States Can Learn From Rhode Island As Sports Betting Expands In 2020

Play Your Tax Cards Right With Gambling Wins And Losses Cmr Associates Llc

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Ri House Bills Would Increase Taxes On High Earners Approve Igt Deal

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

Sports Betting Might Come To A State Near You Tax Foundation

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Rhode Island Slot Machine Casino Gambling Professor Slots

Super Bowl Gamblers Here S Where You Can Bet How You Ll Be Taxed